IRS CP14 Notice: Why Did You Receive This Letter If You Already Paid?

Many Americans have received a CP14 notice from the Internal Revenue Service despite having already paid their tax bill in full.

Thankfully for the majority of people who have been receiving unexpected CP14 notices, it is actually a mistake on behalf of the IRS rather than an extra amount of money that you have to part with.

What is a CP14 notice?

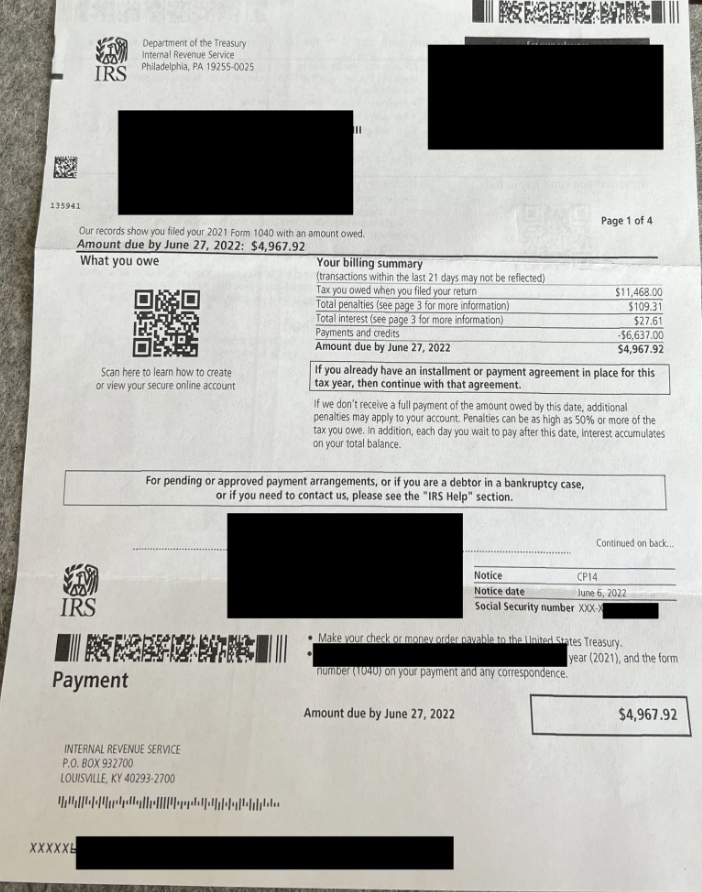

Receiving a CP14 notice means that you have not paid your taxes at all or have paid too little and need to make up the difference. Below is a screenshot of a sample CP14 notice.

Because of a backlog at the IRS lately, there are a lot of people who have not had their proof of payment officially registered yet. That means the system flags those people as having not paid their taxes even if they have.

It is important to check payment records and bank balances to check that you or the IRS have not missed anything.

We recommend you visit www.irs.gov/payments/view-your-tax-account and create an account to check your balance and payment activity.

When creating your account, you will be asked for the following to confirm your identity:

1) Email address (they send a verification code)

2) Account number to one of the following (last eight digits of a credit card, mortgage account number, student loan account number, a few other options)

3) Phone number (they text another verification code)

Once you’ve completed that, your account balance will be displayed on the screen.

All affected clients are encouraged to contact our office. We'll prepare and send a response to the IRS on your behalf.

Be sure to keep a copy of all notices, correspondence, and proof of mailing with your tax documents. Please make sure your tax preparer gets a copy of the notice to keep with your permanent records.