The Internal Revenue Service has launched two new online portals designed for parents to check their eligibility status for payments totaling $3,600 or $3,000, depending on the child’s age. Most families will not need to log in to a portal to receive the payments if they already received stimulus checks but may still want to verify how much they’re getting.

- The first, a Child Tax Credit Update Portal, allows families to check if they qualify for the credit and gives them a choice of opting out of receiving any payments this year.

- The second portal, a non-filers portal, allows people to provide the IRS with basic information about their family if they don’t typically file a tax return. Non-filers have roughly three weeks to register to ensure they’ll get their first advance payment on July 15, 2021.

A third previously established tool, the Child Tax Credit Eligibility Assistant, also helps you determine whether you qualify for the advance child tax credit payments.

Roughly 39 million families are set to receive monthly payments of $300 per child under the age of 6, or a total of $3,600. Families will receive $250 per child ages 6 to 17 for a total of $3,000. The payments begin July 15 and last through December 2021; the other 50% will be a credit on the taxpayer’s 2021 tax return.

- If you don’t want to get the monthly payments, you can use the Child Tax Credit Update Portal if you want to take the full child credit on your 2021 tax return next year. Simply click on “Unenroll from Advance Payments” and sign in with your IRS username or ID.me account.

- You can opt-out at any time but must opt-out at least three days before the first Thursday of the month you’re opting out of. For the July 15 payment, you’d need to opt-out by June 28. Once you opt-out, you can’t opt back in until September.

HOW DO I UNENROLL?

- The link to unenroll: https://www.irs.gov/credits-deductions/child-tax-credit-update-portal

- The first step is to either log in/set up an account with the IRS.

- After logging in, select and affirm that you wish to opt out of the advance payments.

- It is important to note that if your most recent tax return was filed jointly, your spouse would need to unenroll as well, if appropriate.

- Unenrolling is an individual action.

- If your spouse does not unenroll, they will receive payments for their portion of the advance Child Tax Credit.

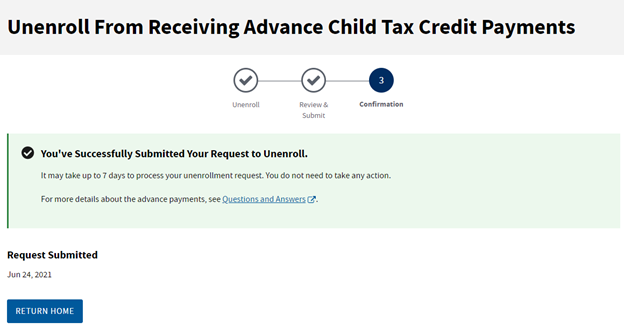

Step 2 is illustrated below – Unenroll

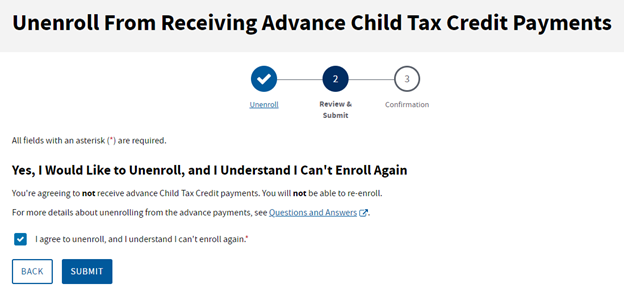

Step 3 is illustrated below - Confirmation