The Pennsylvania Department of Revenue is warning business owners in the state that scam artists are impersonating it and sending fraudulent letters in the mail.

The letters direct business owners to turn over their accounting records with the goal of receiving sensitive financial information, according to the department. The letter tells the business owner that they are being investigated for an “alleged violation of delinquent sales tax liability” and threatens them by saying penalties will be imposed on their accounts.

The letter concludes with contact information for a “resolution officer” and urges the business owner to provide accounting records prepared by a licensed professional, such as an attorney or CPA.

“This is a prime example of fraudsters impersonating a government agency as they try to convince hardworking Pennsylvanians to turn over sensitive information about their businesses,” Revenue Secretary Dan Hassell said. “We are urging Pennsylvania business owners to be on high alert if they receive a suspicious notice that includes the Department of Revenue name and logo. If you have any doubt at all about the legitimacy of a notice from the department, please use the contact information listed on our website, revenue.pa.gov. This is the best way to ensure you are speaking with a legitimate staff member at the Department of Revenue.”

The department said that by providing information, business owners could open themselves up to scammers using the financial data to make unauthorized transactions, request fraudulent tax refunds or even apply for loans under the name of the business.

According to the department, the letters have the Pennsylvania Department of Revenue logo, but they also have suspicious or inaccurate details. The notice does not provide a return address, which the department will always have, and it addresses the recipient only as “Dear Business Owner.” The department said it will typically have the business owner or business name in its letters.

The letter also lists the “Pennsylvania Department of Revenue Tax Investigation & Enforcement Unit” and “Pennsylvania State Revenue and Cash Disbursement Unit,” but the unit names aren’t correct, even though the department does conduct criminal tax investigations. The letter also claims the business is not registered, but the department said most businesses are likely already registered in getting a sales tax license.

The department suggested business owners read the language of the letter carefully and identify vague, blatant factual errors and unexpected, immediate demands. Business owners with questions can submit them online to the department at https://revenue-pa.custhelp.com, which the department promotes as secure.

The scam letter will read along the lines of:

Dear Business owner,

This notice is to inform you that you are under investigation by the Pennsylvania State Revenue and Cash Disbursements Unit.

This investigation involves the alleged violation of delinquent sales tax liability collected per client served and not reported to the Sales and Use Taxation reporting agency.

It appears that you have registered with the United States Internal Revenue Services, but not yet registered your Entity with Pennsylvania Department of State and The Sales and Use Tax division.

Your business engagement requires for the proper accountability, control and payment of sales tax collected to the proper agency.

We are here by requesting for you accounting records of 2019-2020 from a licensed CPA, Attorney, FDIC Banker, Accountant. All and correctly dated and prepared Profit and Loss and Balanced Sheet for each month of each year including Yearly closing Statements. (Self-prepared) reports will not be allowed. All reports must be signed dated and certified by any of the above License Professionals.

Estimated penalties will be imposed. To comply with the auditing officer, please call 1-800-992-1377 immediately.

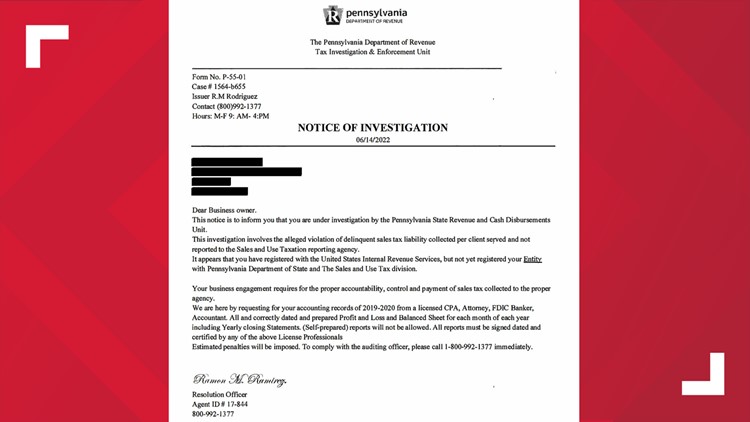

Below is a sample image of the letter. Click on the image to review the full PDF.