SafeSend Gather enables us to securely and electronically manage your entire tax return process from engagement through final delivery. You may already be familiar with SafeSend Deliver. SafeSend Gather handles the intake and document collection on the front end, creating a seamless, paperless experience from start to finish.

Getting Started with SafeSend

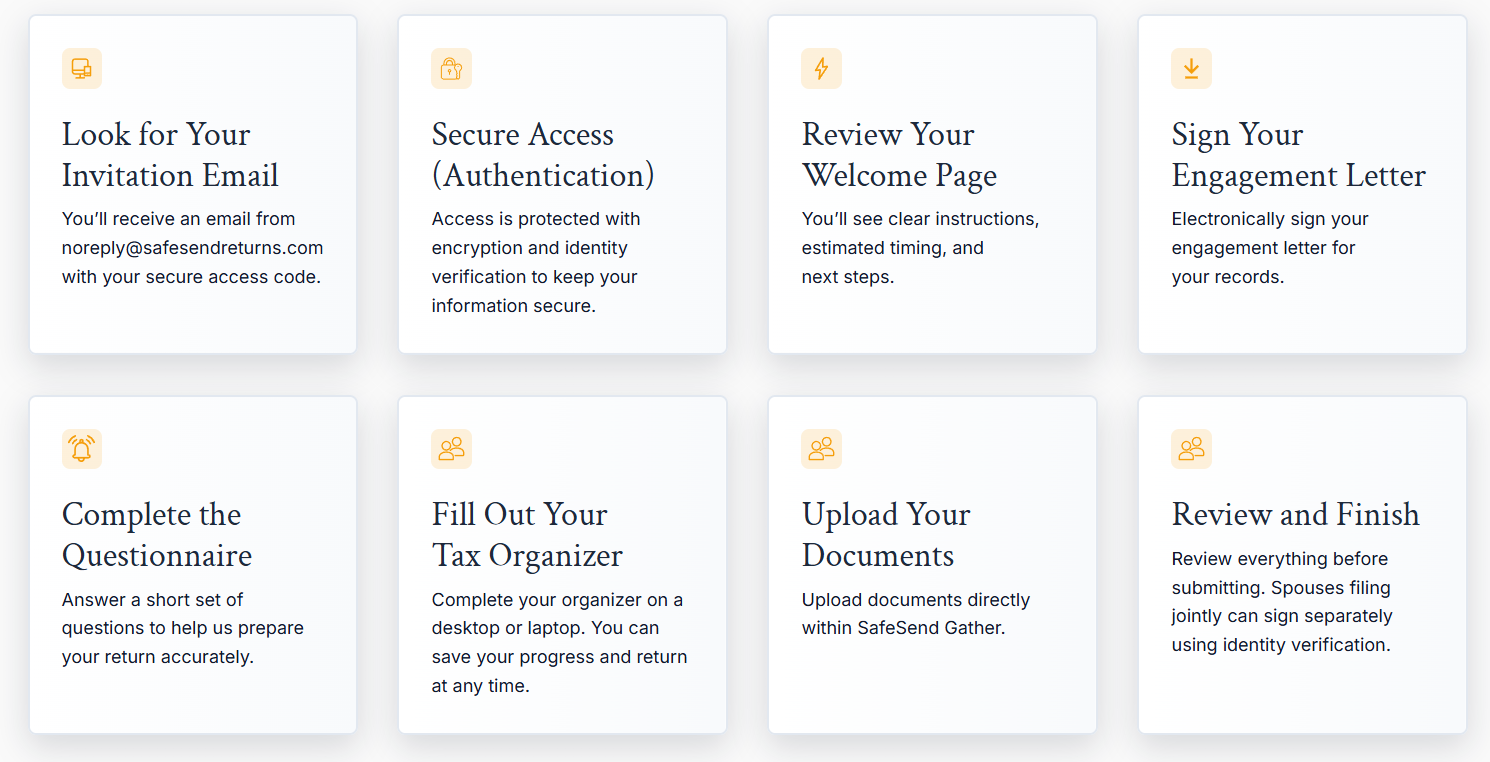

SafeSend Gather is designed to make completing your tax organizer and uploading documents simple, secure, and organized. Here’s what you can expect from start to finish.

Uploading Documents Made Easy

Everything stays organized in one place, with no back-and-forth.

- Upload documents directly within SafeSend Gather

- Files are automatically recognized and categorized when possible

- Any unrecognized items are placed in an “Uncategorized” folder for easy review

- All documents are stored securely and remain accessible throughout the process

Accepted file types: PDF, Word, Excel, Text, PNG, JPEG

Please note: Password-protected or encrypted files cannot be uploaded.

What Happens Next?

Once all steps are complete, our team begins preparing your return. When your tax return is ready, you’ll receive it through SafeSend Deliver for secure review and electronic signing. You’ll be notified as your return moves through review and once it’s ready for delivery.

Helpful Tips

Don’t know where to start? Here’s a video tutorial to walk you through the process: Watch Video

Please be sure you mark your organizer “Finished” once you are ready for our team to download the organizer. By selecting the GREEN “FINISH” button, you are letting us know you have finished the organizer step. If you have additional documents that need to be added, please reach out directly to your Brinker Simpson advisor.

Do I need to sign a new engagement letter every year?

Yes, Brinker Simpson requires a new signed engagement letter each year for each entity.

I prefer to fill out a paper organizer. How can I print a copy?

After you open the SafeSend Organizer, click “Complete Organizer,” then click the download icon in the top right to save and print a copy.

Can I start the organizer and come back to it later?

Yes. To save your work, click the “Save & Close” button in the bottom right corner.

Can my spouse and I access the organizer at the same time?

While the program allows both taxpayer and spouse to access the organizer simultaneously, we do not recommend it. If both parties make changes, it will only retain what the last person saves.

What does the paper clip icon mean?

Certain pages of the organizer will show a paper clip icon. These pages allow you to directly upload source documents that correspond with that page.

Where should I note a major life event (marriage, birth of child, sale of a home)?

Use the “Notes to Tax Preparer” box in the bottom right corner to notify Brinker Simpson about major changes or provide additional information related to an organizer page. All notes are compiled onto a page at the end for your tax preparer to review.

If I type in the Notes section, will my question be seen immediately?

The Notes section is not a live chat feature. It is a limited area to provide a quick note to your Brinker Simpson advisor for the page you are on and will be read once we begin preparing your tax return.

What type of files can I attach?

We prefer PDF files of your tax documents, but we can also accept JPEG, Word, and Excel files. If you attach a JPEG image, please make sure it is clear and legible.

Where can I attach files that don’t have an organizer page? Can I upload tax documents after I finish my organizer?

After you have completed all relevant sections of the organizer, click the green “Finish” button in the bottom right corner. You will be taken to the home screen, where you can click “Upload Documents” to attach any additional files.

I finished uploading source documents—what is the difference between “Complete Later” and “Finish”?

When you have completed the organizer and uploaded your source documents, you will be given two options. Select “Finish” if you are confident you have submitted all your tax documents and are ready for Brinker Simpson to prepare your return; this will lock your organizer and you will not be able to make changes or add more files. Select “Save & Close” if you are still waiting on additional documents and plan to return later.

What internet browser should I use?

For the best experience, we recommend using Google Chrome. SafeSend will also work with Safari, Firefox, and other modern browsers, but we strongly discourage using Internet Explorer, as SafeSend does not work well with it.

Can I use a mobile device or iPad?

Yes. You can use your phone or iPad to sign your engagement letter and upload documents, including taking pictures of documents to upload securely.

I don’t have a scanner. What should I do?

You can use the camera on your phone or iPad to take pictures of documents and then upload them. Please ensure the documents are well lit, flat, and clearly legible.

I completed uploading documents but have additional files to send. What should I do?

If you have additional documents that need to be added after you’ve finished, please reach out directly to your primary Brinker Simpson contact.

Who do I contact if I have questions?

If you have any questions about SafeSend or your organizer, please reach out to your primary contact at Brinker Simpson & Company, or call our office at 610-544-5900.

Brinker Simpson & Company, LLC

1400 N Providence Road

Rosetree Building 2, Suite 2000E

Media, PA 19063