Navigating Your TaxCaddy Software and Document Submission Process

As we navigate another tax season together, we want to ensure your experience with TaxCaddy and our workflow is as smooth and efficient as possible. We've received helpful feedback and noticed a few common areas of confusion regarding document submission and account access. To address this, we've compiled some tips to guide you through the process.

Accessing Your TaxCaddy Account (Returning User)

As a returning client, your TaxCaddy account remains active and accessible. Here's how you can access your account or reset your credentials if necessary:

- Access your TaxCaddy account using the email address linked to your account.

TaxCaddy Login Page

: https://consumer.taxcaddy.com/#/login

- If you've forgotten your password or are having trouble logging in, please visit the Forgot Password Page to reset your credentials.

- Forgot Password: https://consumer.taxcaddy.com/#/forgot-password

In January 2024, we sent you an email containing access information for your TaxCaddy account and client questionnaire. This questionnaire is crucial for continuing your tax preparation process efficiently and without delay.

Please check your inbox or spam folder for a message from NoReply@taxcaddy.com, which provides essential instructions and access for engaging with our tax preparation services.

Important Reminder

: Please do not attempt to sign up for an account directly via taxcaddy.com.You must access your account via the email sent in January

containing a link customized explicitly for you and our Firm. This process ensures your setup is correctly linked to our tax preparation services and secures your personal information.Accessing Your TaxCaddy Account (New User)

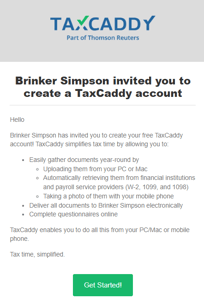

- Email notification: Within 24 hours, you will receive an email from TaxCaddy inviting you to create your TaxCaddy account. The email invitation will come from NoReply@taxcaddy.com and will contain instructions with three easy steps to start.

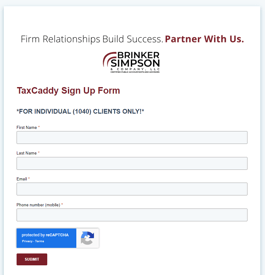

Sign up:

Complete the form to begin your simplified tax preparation journey: https://share.hsforms.com/1IGTP-2n9Spic6tOA8rwFIw1hyij

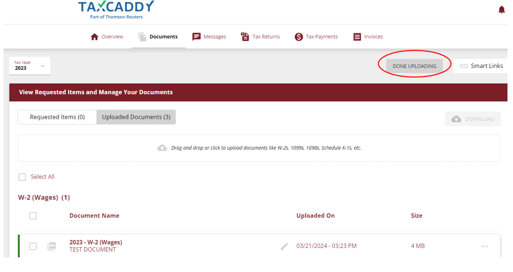

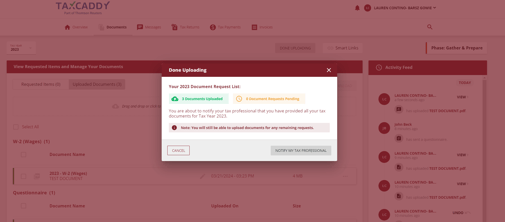

Important Reminder: Uploading Documents

Notifying your preparer after uploading your documents is crucial to ensuring your tax preparation process progresses without delays.

Please click the "

Done Uploading

" button above the "View Requested Items and Manage Your Documents" box. This action alerts your preparer that your documents are ready for review and moves your tax process forward.

We hope this information helps clarify the steps needed to ensure a seamless document submission process. Your cooperation and proactive engagement with TaxCaddy are appreciated, as they play a vital role in enabling us to serve you better.

For additional information and support, visit www.brinkersimpson.com/taxcaddy.